Qualcomm Share Price: A Comprehensive Analysis

Introduction

Qualcomm Inc. is a globally renowned technology company specializing in semiconductors and telecommunications equipment. The company’s stock, traded on the NASDAQ under the ticker symbol QCOM, has been a favorite among investors interested in technology and innovation.

Qualcomm’s Business Model

Qualcomm’s core business revolves around the development and commercialization of wireless telecommunications technologies, notably in the realm of 5G. The company licenses its intellectual property to other tech firms and sells semiconductors that power smartphones, tablets, and other wireless devices. This dual revenue stream from licensing and product sales provides the share price of Qualcomm with a robust and diversified income source, influencing its stock’s stability and growth potential.

Historical Performance

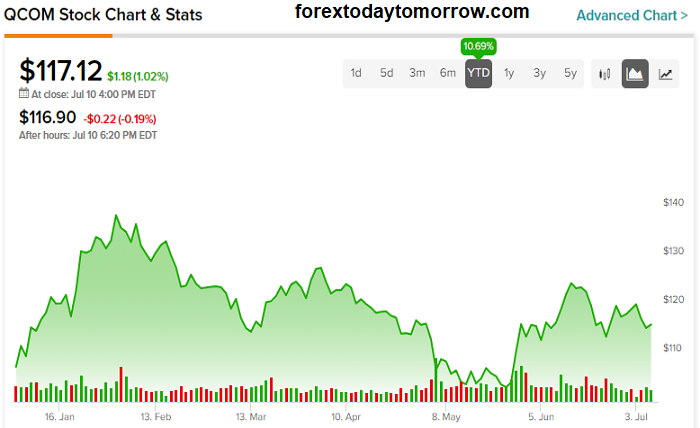

Qualcomm has experienced significant growth since its inception, with its stock price reflecting the company’s successful business model. Over the past decade, QCOM’s share price has seen steady growth, with occasional fluctuations due to broader market trends or industry-specific factors. Notably, the roll-out of 5G technology has positively impacted Qualcomm’s share price, as the company plays a critical role in its development and implementation.

Market Trends and Qualcomm’s Response

The broader technology market’s trends heavily influence Qualcomm’s share price. The demand for wireless technology and mobile devices drives revenue growth, while the adoption of 5G networks creates new opportunities for the company. Qualcomm has responded to these trends by investing in research and development and forming strategic partnerships with key players in the industry, further strengthening its position and positively impacting its share price.

Impact of Global Events

Global events, such as trade disputes and pandemics, can have a significant effect on Qualcomm’s share price. For example, the US-China trade tensions have occasionally impacted Qualcomm due to its reliance on the global supply chain and significant customer base in China. Similarly, the COVID-19 pandemic created disruptions in production and supply chains, affecting the company’s broadcom stock price. Despite these challenges, Qualcomm has shown resilience, adapting its operations to maintain stability.

Regulatory and Legal Factors

Qualcomm’s share price is also sensitive to regulatory and legal factors. The company has faced antitrust allegations and legal battles with other technology companies over patent licensing. These legal issues can create uncertainty and volatility in the share price. However, Qualcomm has successfully navigated many of these challenges, demonstrating its ability to withstand regulatory pressures.

Investor Sentiment and Analyst Outlook

Investor sentiment plays a critical role in determining Qualcomm’s share price. Positive news about the company’s earnings, partnerships, or product developments can lead to a surge in share price, while negative news can have the opposite effect. Additionally, financial analysts’ outlooks and recommendations influence investor sentiment. Generally, Qualcomm has received favorable analyst ratings, contributing to a positive perception among investors.

Future Prospects and Challenges

Qualcomm’s future prospects are closely tied to the continued expansion of 5G technology and the growth of the Internet of Things (IoT). As these trends gain momentum, Qualcomm stands to benefit significantly, which could positively impact its share price. However, the company faces challenges, such as increasing competition and potential legal hurdles, which could affect its performance.

Conclusion

Qualcomm’s share price reflects the company’s resilience, innovative business model, and its ability to adapt to changing market conditions. While the stock may experience volatility due to external factors, its long-term prospects remain promising. Investors interested in technology and telecommunications will likely find Qualcomm’s stock an attractive option, but they should stay informed about industry trends, global events, and regulatory developments to make well-informed investment decisions and Visit 5paisa for top deals.