PacWest Bancorp (PACW) Stock Forecast: A Potential Turnaround in 2023?

PacWest Bancorp (NASDAQ: PACW) is a financial holding company that operates through its subsidiary, Pacific Western Bank, one of the largest banks based in California. The company provides banking products and services to individuals and businesses, with a focus on commercial lending and deposit gathering. PacWest Bancorp has over 75 full-service branches throughout the state and serves various industries, such as healthcare, technology, entertainment, real estate, and manufacturing.

How PacWest Bancorp Performed in 2022?

PacWest Bancorp had a challenging year in 2022, as the COVID-19 pandemic and the resulting economic downturn adversely affected its business operations and financial performance. The company reported a net loss of $1.2 billion for the full year 2022, compared to a net income of $465 million in 2021. The loss was mainly due to a significant increase in the provision for credit losses, which rose from $95 million in 2021 to $1.6 billion in 2022, reflecting the deterioration of the credit quality of the company’s loan portfolio.

The company’s revenue also declined by 15% year-over-year, from $1.2 billion in 2021 to $1 billion in 2022, as the net interest income decreased by 12% and the non-interest income dropped by 28%. The net interest margin, which measures the difference between the interest income and the interest expense as a percentage of the average earning assets, contracted by 49 basis points, from 4.93% in 2021 to 4.44% in 2022. The lower net interest margin was mainly due to the lower interest rate environment and the higher level of liquidity on the balance sheet.

The company’s operating expenses also increased by 9% year-over-year, from $507 million in 2021 to $554 million in 2022, mainly due to higher compensation and benefits costs, merger-related expenses, and FDIC insurance premiums. The company’s efficiency ratio, which measures the operating expenses as a percentage of the revenue, worsened from 42.3% in 2021 to 54.9% in 2022.

The company’s capital ratios remained strong and well above the regulatory minimums, despite the net loss. The company’s tangible common equity ratio was 8.9% as of December 31, 2022, compared to 9.7% as of December 31, 2021. The company’s total risk-based capital ratio was 14.5% as of December 31, 2022, compared to 14.8% as of December 31, 2021.

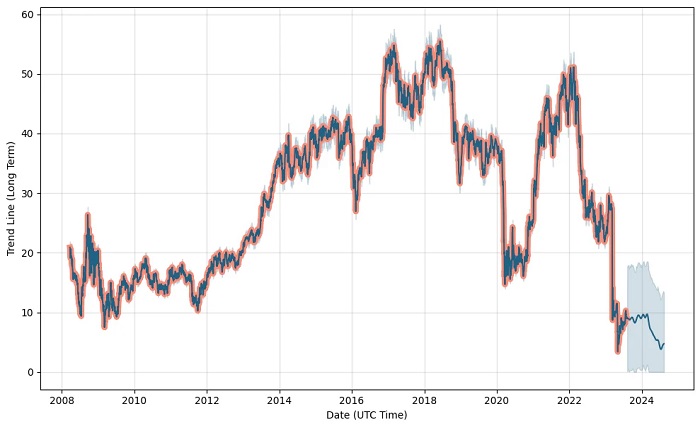

The company’s stock price also suffered a significant decline in 2022, falling by more than 60% from its peak of $30.43 in February to its low of $8.73 in August. The stock underperformed the broader market and its peers in the banking sector, as investors lost confidence in the company’s ability to weather the crisis and generate profitable growth.

Read more about: remakerai

What are the Analysts’ Expectations for PacWest Bancorp in 2023?

Analysts have mixed opinions on PacWest Bancorp’s prospects for 2023, as they expect the company to recover from its losses but remain cautious about its growth potential and credit risk exposure. According to MarketBeat, the consensus among 10 analysts is to hold the stock, with an average rating score of 2.44 out of 5. The analysts have a median price target of $20.08 for the stock, which implies an upside of about 130% from its current price of $8.73. The lowest price target is $8.00 and the highest is $35.00.

The analysts expect PacWest Bancorp to report a positive earnings per share (EPS) of $0.88 for the full year 2023, which represents a significant improvement from the negative EPS of $0.90 in 2022. However, this also implies a decline of more than 50% from the EPS of $1.86 in 2021. The analysts also expect the company’s revenue to increase by about 10% year-over-year, from $1 billion in 2022 to $1.1 billion in 2023.

The analysts’ forecasts are based on several assumptions and factors that could affect PacWest Bancorp’s performance in 2023, such as:

- The progress of the COVID-19 vaccination program and the easing of lockdown restrictions, which could lead to a recovery of economic activity and consumer spending.

- The stabilization or improvement of the credit quality of the company’s loan portfolio, which could reduce the provision for credit losses and the net charge-offs.

- The maintenance or enhancement of the net interest margin, which could benefit from the repricing of the loan portfolio and the optimization of the balance sheet composition.

- The realization of cost synergies and revenue opportunities from the acquisition of Opus Bank, which was completed in June 2022.

- The continuation of the dividend payments and the share repurchases, which could support the stock price and the shareholder value.

Read more about: facecheckid

Conclusion:

PacWest Bancorp is a company that has faced significant challenges in 2022, as the COVID-19 pandemic and the economic downturn negatively impacted its business operations and financial performance. The company reported a net loss of $1.2 billion for the full year 2022, as it increased its provision for credit losses to account for the deterioration of its loan portfolio. The company’s revenue also declined by 15% year-over-year, as the net interest income and the non-interest income decreased. The company’s operating expenses also increased by 9% year-over-year, as it incurred higher compensation and benefits costs, merger-related expenses, and FDIC insurance premiums. The company’s stock price also plunged by more than 60% from its peak in February to its low in August.